Surviving & Thriving: The Strategic Investor’s Guide to the VUCA Era

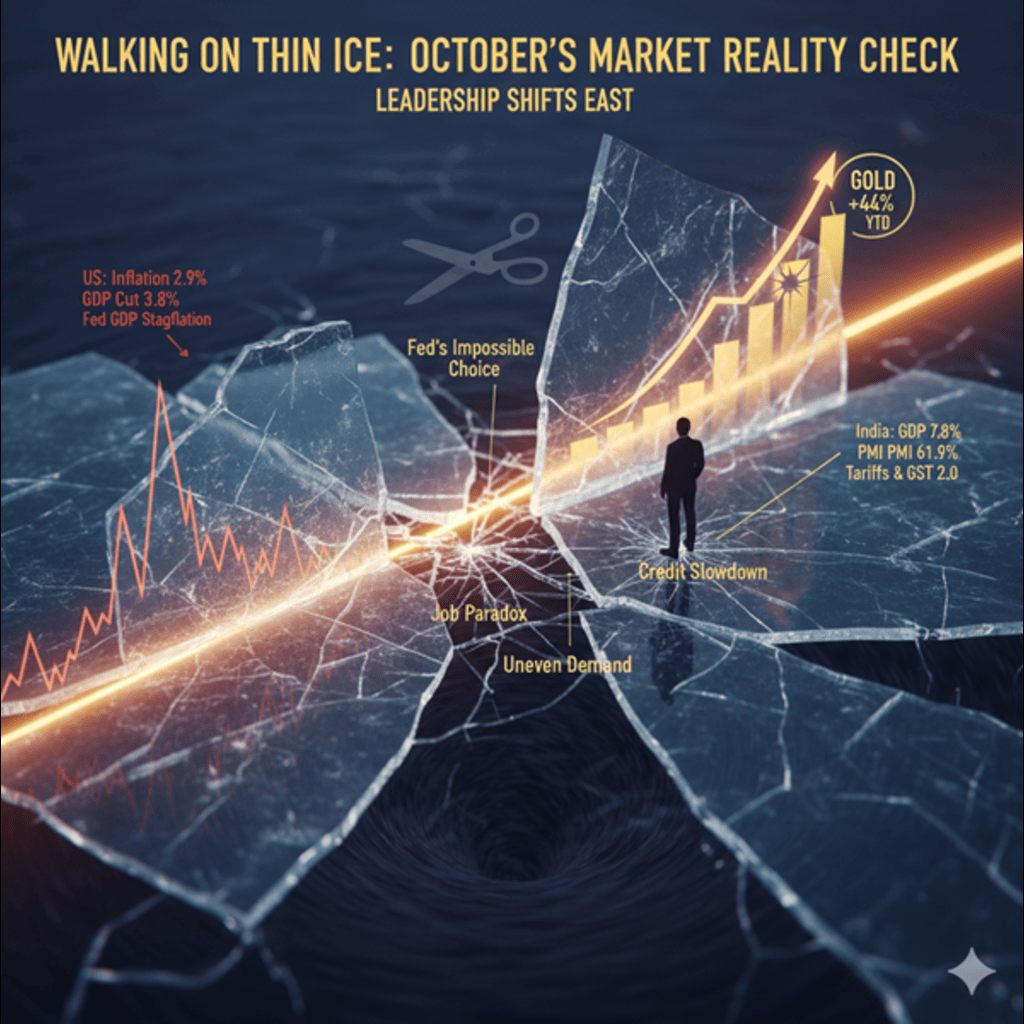

Imagine standing in a storm. Lightning zigzags above, winds twist unpredictably, the ground trembles. In 2025, this is our investment landscape. Are you holding your ground, or are you swept away? Investing has never felt more like navigating that real-life storm: daunting, confusing, exhilarating, and, if you are ready, full of untapped opportunity.

Welcome to VUCA: The New Reality

VUCA is more than another buzzword; it is how our world now operates:

- Volatility: Markets swing wildly on every rumour or data point.

- Uncertainty: Yesterday’s forecast does not survive till lunch.

- Complexity: Everything is tangled; Think geopolitics, pandemics, tech shifts.

- Ambiguity: Clear signals are rare; more often it is static and noise.

In short, traditional “rulebooks” have become flimsy. Just reflect:

Interest rates ricochet. Inflation keeps investors and policymakers guessing. A single trade headline can jolt global markets awake at 2 a.m. Wars, supply chain disruptions, and energy crises layer risk upon risk. Even technology, once a steady growth engine, is now an unpredictable disruptor reshaping winners and losers at breakneck pace.

Why does this matter? Because it is your savings, your retirement, your organization’s future on the line. Now more than ever, the old ways will not keep you safe.

Lessons Carved in History: Learning from the 1970s

Let us anchor our strategy in a period that echoes today: the 1970s.

That decade witnessed the perfect VUCA storm:

- Oil embargoes sent energy prices soaring.

- Inflation spiked to unimaginable highs.

- The stock market collapsed, and even normally “safe” bonds turned toxic.

It was terrifying and instructive. Investors who clung to a single asset type (say, only stocks or only bonds) lost ground. Those who ventured into hard assets, precious metals, real estate, commodities, weathered the storm far better. Value stocks, defensive sectors, and flexible, tactical strategies delivered shelter when the skies darkened.

If history whispers one thing, it is this: diversify and seek real, uncorrelated returns. Do not depend on yesterday’s safe harbours to withstand today’s squalls.

A Modern Playbook: Strategic Moves from the Frontlines

How are forward-thinking investors adapting today?

- Broaden Horizons: Savvy allocators now look to India and select high-growth emerging markets regions that might shine while others stumble. These markets offer a mix of growth, resilience, and insulation from West-centric shocks.

- Lean Into Hard Assets: Commodities (think gold, silver, even agricultural products) are no longer fringe. They are centre stage, not just as hedges but as potential performance drivers when inflation roars or global supply chains strain.

- Read the Right Signals: Gold, once merely a store of value, is being watched as a weather vane for policy changes and risk sentiment. When gold rises sharply, it is often the market’s whisper that something fundamental is shifting.

- Avoid Fragility: Developed markets with deep policy and demographic challenges are being approached with caution. Rather than chase the latest “hot” growth story, this is a moment for patience, quality, and reasonable valuations.

- Stay Agile, Stay Balanced: The winners employ a multi-asset approach, spreading risk across stocks, real assets, and even currencies to stay flexible. Their mantra: “be agile with macro, patient with micro.”

Diversification: Your Lifeline Against the Unknown

Here is a simple truth: In a VUCA world, diversification is not optional. It is survival.

Ask yourself: If you put all your eggs in one basket and that basket drops, what is left? Concentrating risk was always dangerous, but now, with shocks coming from every unpredictable angle, it is reckless.

- Diversify by asset class: Blend equities, commodities, real estate, and alternatives.

- Diversify by strategy: Embrace both growth and defensive plays; blend active and passive approaches.

- Diversify geographically: Downgrade “home bias,” the idea that your local market offers all the answers. This one however, is tricky. If you are sitting in the next growth engine, then you can stay neutral or overweight on your home country.

Why is this so powerful? Because when one piece of your portfolio zigs (falls), another always zags (rises). The data is clear: diversified, multi-asset portfolios avoid catastrophic losses and give you the dry powder to buy low and sell high. Over decades, this discipline yields solid, reliable returns, while “bet-the-farm” strategies may offer fireworks, but rarely end well.

Practical Steps to Build VUCA-Ready Resilience

The prepared investor is not the boldest gambler, nor the most cautious hoarder, but the most flexible planner. Here is how to build your VUCA-toolkit:

- Embrace True Diversification: Do not hedge your future on a single country, asset, or sector. Spread your bets intelligently.

- Value Capital Preservation: Avoid ruin at all costs. Maintain buffers, stress-test scenarios, and keep enough liquidity so you can sleep at night and seize opportunity when others panic.

- Include Inflation Hedges: Commodities and real estate are now essential, not eccentric. Do not wait for inflation to spike before you react.

- Focus on Quality and Long-Term Trends: Home in on companies and assets with thick moats and enduring demand these can ride out any short-term squall.

- Stay Agile, Watch the Signals: Let data, not fear, drive your shifts. Monitor indicators like gold, volatility indexes, and policy signals, but react with discipline, not emotion.

- Think Resilience, Not Just Return: The wise investor’s goal is not the biggest possible gain, but the ability to take a punch and keep moving forward. Survival is the prerequisite for thriving.

Closing Thoughts: Courage, Clarity, and Your Future

In these turbulent years, fortune doesn’t simply favour the bold, it favours the prepared.

So, when the world feels like a storm, remember: You don’t need to predict every wave.

You need a raft that floats, a map that adapts, and the courage to keep paddling.

Build a portfolio that can bend but never break. Diversify with intent. Embrace history but refuse to repeat its mistakes blindly. And invest with strategy, not just fear.

The VUCA world will not give you guarantees. But it does offer unique opportunities to those with the vision to see, the strategy to act, and the resilience to endure. Let that be you.