The India Edge: Why You Should Not Miss the World’s Most Compelling Market Opportunity

Imagine Investing in the Next Global Giant

Picture yourself standing at the intersection of history and opportunity. A market brimming with over a billion aspirations, hungry for progress, braced for growth. The world is tilting, after decades of Western market dominance, the torch is passing. Welcome to India, the heartbeat of a new economic era, and the smartest investment destination of the late 2020s.

Let us embark on a journey to decode why the world’s eyes, and capital, are turning to India. Whether you are a retail investor, a high-net-worth individual, or guiding a family office, these insights will speak directly to your ambitions and dreams.

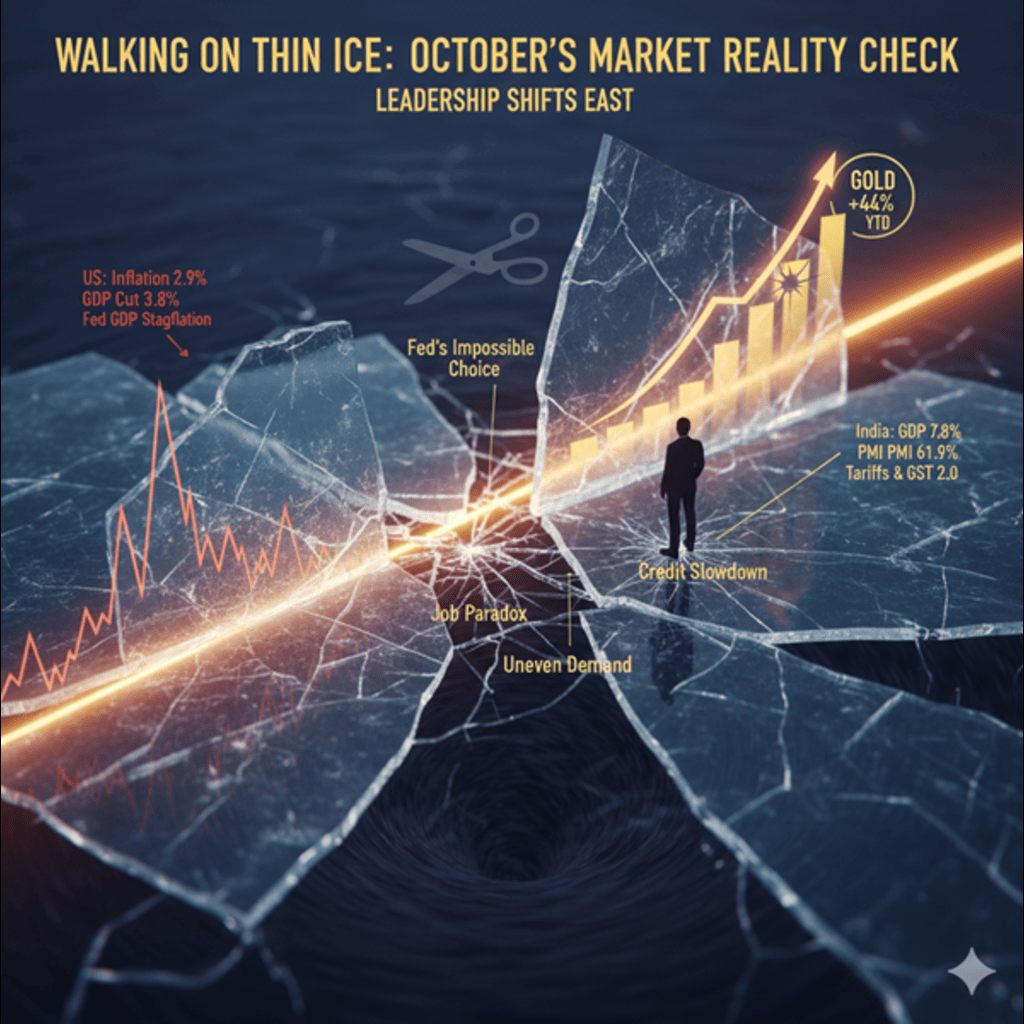

India: Rising in a Shifting Global Landscape

After years under the spell of the U.S. market’s magic, global investors now sense something seismic shifting beneath the surface. Developed economies are wrestling with flatlining growth, while China, once the default emerging market darling, is slowing down and tightening control.

And then there’s India, a nation surging ahead, not merely riding a passing wave, but powered by deep, structural strengths. What is happening in India is not a fleeting boom. It is a transformation.

Three Pillars of India’s Ascent :

1. Demographics: A Young Nation Set to Lead

India’s greatest asset? Its people. Over 40% of its population is under 25. That is a youthquake of energy, creativity, and hunger for the future. The median age is just 28, meaning India will boast one of the world’s youngest, and most productive, workforces for decades.

Every year, millions more move to cities, learn new skills, and enter the digital economy. By 2050, an additional 400 million people will be urban dwellers. This young, urban India is tech-savvy and globally aware, setting the stage for unprecedented consumer demand and innovation.

2. Growth: Speed and Breadth Like Nowhere Else

India is not just growing, it is leading. GDP is powering forward at roughly 6.5-7%, unmatched by any other major economy. What is remarkable is the spread: from manufacturing turbocharged by “Make in India” policies to a service sector led by IT giants, to digital infrastructure connecting village and metropolis alike. India’s resilience? It is not dependent solely on exports, domestic demand is the powerhouse.

3. Prosperity Rising: The New Indian Middle Class

Think about this: in just 20 years, India’s per capita GDP has doubled. By 2030, over half of its people will be middle class, fuelling an explosion in consumer demand for everything from smartphones to financial products and luxury goods.

In terms of purchasing power, India is already the third-largest economy worldwide. That means vast, untapped markets, waiting to be built, discovered, and invested in.

A Market Built on Confidence: Domestic Strengths

- Consumption Rules: Domestic spending makes up about 60% of GDP.

- Savings Fuel Growth: High personal savings rates channel billions into mutual funds and equities every month, making local investors a stabilizing force against global volatility.

- Market Depth: Indian equities are not just about a few big players, sector diversity and reforms like T+1 settlements, strong governance, and innovative technology platforms make India’s capital markets vibrant and robust.

India’s government is not sitting still either. Reforms, from GST to digital IDs and instant payments, are formalizing the economy, driving transparency, and sparking fresh growth.

The India Comparison: Why the World Is Switching Focus

| Country | Key Limitation | India’s Edge |

| China | Aging, overregulated | Young, open to business |

| Brazil | Growth, politics | Diversified, stable |

| Indonesia | Scale, market depth | Larger, more integrated |

India is standing tall not just within Asia, but globally a magnet for capital shifting from other emerging markets.

Risks: The Realities to Watch

Let us be honest every excellent opportunity casts some shadow.

- Political Change: India’s reform engine is tied to political leadership. Policy continuity is key.

- Bureaucracy & Infrastructure: Progress is real, but bottlenecks and red tape still exist. Education, skilling, and gender inclusion need attention.

- Geopolitics: Tensions with neighbours, especially China and Pakistan, need to be watched. However, major disruptions appear unlikely.

- Global Headwinds: Volatile oil prices or currency swings could affect the markets temporarily.

SWOT Analysis: India’s Investment DNA

| Strengths | Weaknesses |

| Young workforce | Infrastructure lag |

| Rapid GDP growth | Human capital gaps |

| Robust consumption | Fiscal deficit |

| Deep equity market | Regional inequality |

| Opportunities | Threats |

| “China+1” movement | Border tensions |

| Digital economy boom | Global shocks |

| EM market rub-rating | China rivalry |

The Strategic Case: Why NOW Is India’s Moment

Let us zoom out. India is not just a headline anymore it is the strategic crescendo in the global investment symphony. The late 2020s are shaping up to be the decade of emerging markets, and within them, India is the lead soloist. This is about more than numbers; it is about being part of a story that is rewriting the global order.

For every investor asking, “Where do I find sustainable growth, real resilience, and transformative scale?” the answer is clear. India.

You are not just investing in a country or a market. You are investing in a billion dreams, a unique demographic force, world-class innovation, and the rise of a new global engine.

Your move. Will you watch this moment unfold or become a part of India’s ascent?