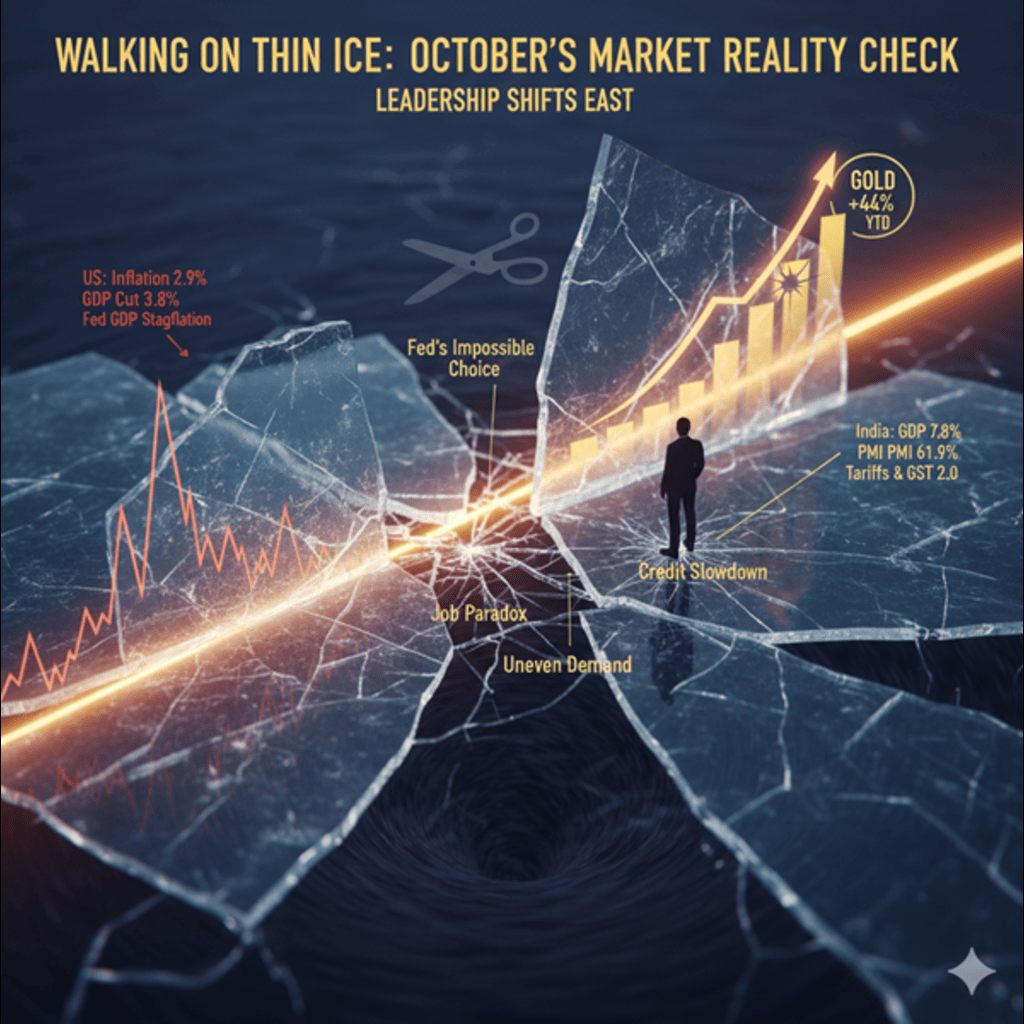

Walking on Thin Ice: October’s Market Reality Check

The markets in October 2025 told a story of divergence, where confidence meets caution, where growth masks underlying strain, and where the world’s economic leadership quietly shifts eastward. This isn’t your typical market commentary. This is about reading between the lines of what the data whispers and what the headlines shout.

The Global Fragmentation: Different Engines, Different Destinations

The global economy has fractured into distinct narratives, each moving at its own pace toward an uncertain destination.

India continues to lead with a composite PMI of 61.9 and a GDP growth rate of 7.8%, standing out as a standout performer in a sluggish global economy. Inflation sits at a manageable 2.1%, giving the Reserve Bank of India room to manoeuvre. But this strength comes with cracks beneath: tariffs on pharma exports, H-1B visa restrictions, and credit growth slowing to single digits.

The United States presents a more troubling picture. With a PMI of 53.6 and GDP growth of 3.8%, the numbers look respectable on the surface. But dig deeper: inflation is still sticky at 2.9%, unemployment is climbing, and the Federal Reserve just cut rates by 50 basis points despite inflation being above target. This isn’t strength. It’s a policy paradox. The Fed is cutting rates not because the battle against inflation is won, but because the job market is faltering.

China has slipped back into deflation territory, with a rate of -0.4%, despite a mild GDP recovery of 1.1%. Stimulus efforts provide temporary relief, but deflationary pressures persist, signalling deeper structural challenges.

Europe and the UK struggle with stagflation risks where the growth is barely positive, inflation is sticky, and policy options are limited. The Eurozone’s 0.1% GDP growth and the UK’s 0.3% suggest economies treading water rather than swimming forward.

The Fed’s Impossible Choice

Last month, we warned that a rate cut in the wrong storm isn’t relief, it’s risk. And that’s exactly what played out.

The Federal Reserve cut rates from 4.25% to 4% in September despite inflation staying above the 2% target. Why? Because unemployment is rising, job openings are shrinking to a one-year low, and non-farm payroll growth has stalled. The Fed is caught between two fires: inflation that won’t cooperate and an employment picture that’s deteriorating.

Yields initially dropped on the rate cut expectation, then bounced back exactly as expected. Markets can cheer headlines temporarily, but they can’t defy economic gravity indefinitely.

Policy Shocks: H-1B and Pharma Tariffs

Two policy bombshells hit Indian markets in September:

The H-1B Visa Shock: The US raised the H-1B visa filing fee to $100,000 per visa, up from just a few thousand dollars. The Nifty IT index plunged approximately 8% in one week as the market absorbed the implications. Indian IT firms, the largest recipients of H-1B visas, face an estimated 10-20 basis point hit to operating margins.

But here’s the counterintuitive opportunity: fewer US visas mean more talent stays home. What hurts margins today could fuel India’s emergence as a global tech delivery and innovation hub tomorrow. Engineers who would have left now power domestic startups, offshore delivery models strengthen, and India’s march toward tech self-reliance accelerates.

The 100% Pharma Tariff: The US imposed 100% tariffs on branded pharmaceutical imports, directly targeting India, which supplies roughly 40% of US generic drugs and the bulk of global active pharmaceutical ingredients (APIs).

Yet India’s role as the “pharmacy of the world” makes it indispensable. Tariffs can raise costs, but they cannot replace decades of trust, manufacturing expertise, and supply chain integration. Meanwhile, China picks up demand slack as India rebalances exports eastward.

GST 2.0: The Silver Lining

Amid external headwinds, India delivered a domestic policy win with GST 2.0, fewer slabs, simpler compliance, and strategic timing ahead of the festive season.

Tax brackets were reduced from four to effectively 2.5, with significant cuts across consumer-facing categories: food and staples moved to 0%, medicines and medical devices to 5%, consumer electronics to 18%, and small cars to 18% from 28% plus cess.

The math works: consumers save approximately ₹48,000 crore, government revenue loss is cushioned by higher taxes on luxury and sin goods, and inflation gets a structural downward push. This gives the RBI more room to cut rates if needed and hands consumers more spending power during the critical festive shopping season.

Winners include FMCG, healthcare, consumer durables, and overall domestic demand.

The Macro Paradox: Goldilocks on Thin Ice

India’s macroeconomic position appears ideal. Strong growth, low inflation, robust PMIs, and solid business confidence. Yet warning lights flash beneath the surface:

Credit Fatigue: Bank credit growth has slowed to 9.9% year-over-year, down from over 17% a year ago. Agriculture credit fell to 7.3%, services to 10.6%, and industry to 6%. Even unsecured loan growth, previously a red-hot segment, is cooling. Money supply (M3) has thinned for three consecutive months, signalling tighter liquidity conditions.

Employment Paradox: The headline unemployment rate improved to 5.1%, but the Naukri Job Index dropped to 2,664, showing weak actual hiring momentum. Labour force participation stays stuck at 41.4%, suggesting growth isn’t translating into broad-based job creation. Youth unemployment hovers near 19%, a potential political flashpoint ahead of elections.

Uneven Demand: Rural India and infrastructure sectors show resilience, tractor sales are firm, cement production grew 6%, and steel production surged 14%. But urban consumption lags: passenger vehicle sales are flat, air traffic is stuck at 14 million passengers, and two-wheeler sales are still soft.

Consumer confidence is stable, but spending patterns reveal a two-speed economy where rural resilience can’t fully compensate for urban caution.

Gold’s Euphoric Run: Safe Haven or Mania?

Gold surged 44% year-to-date in India, with 24-karat gold prices hitting record highs near ₹1,14,480 per 10 grams. Central banks worldwide are accumulating gold aggressively, and investors are piling into the traditional safe haven.

But when safe havens become the talk of the town outside a recession, it is worth asking: is this prudence or euphoria? The current gold bull run mirrors patterns from the 1970s and 2000s, where prolonged rallies eventually gave way to corrections. Gold deserves a place in portfolios, but at these levels, it may need to take a breather.

Crude oil, meanwhile, has stabilized between $60-70 per barrel after steep declines earlier in the year. Demand is still mixed: green energy transitions, sluggish advanced economy growth, and weak industrial activity cap upside, while geopolitical risks and supply adjustments provide a floor.

October’s Historical Volatility

October has earned its reputation as the market’s most volatile month. From 1945 to 2008, October repeatedly shook investor confidence with sharp corrections and dramatic reversals.

Volatility is not noise. It is the price of staying invested. Markets do not reward complacency; they respect discipline.

Portfolio Positioning: Conviction with Caution

Based on the October analysis, the strategic positioning is:

Equities: Slight overweight, with India at the centre. Among Indian sectors:

- Overweight: Real estate (inflation end-cycle benefit), consumer durables and staples (affordability + premiumization), infrastructure (capex momentum), energy, and metals (commodity tailwinds + China stimulus), public banks (credit growth + attractive valuations), and pharma (defensive strength + export support)

- Neutral: Private banks (healthy but fairly priced)

- Underweight: Autos (weak core volumes + tariff risks) and IT (global budget pressure + H-1B shock)

Debt: Neutral across durations. Yields are stable but without clear catalysts. Corporate spreads are stable but lack compression potential.

Cash: Trimmed from prior months. With valuations improving and opportunities appearing, holding excess cash is less compelling. Cash allocation reduced to 9-15% across portfolios.

Gold: Moderating from earlier overweight. Still compelling but due for consolidation after the 44% year-to-date surge.

Market Technicals: Testing Resilience

The market is retesting demand zones identified in September. The initial demand zone held firm when tested, rallied into supply zones, sold off, and is now testing demand again.

If the current demand zone fails, a larger support zone sits just below. Supply zones have lightened, reducing froth. Macro tailwinds, 7.8% GDP growth and low inflation, support resilience, making the current risk-reward more favourable than in September.

The Bigger Picture: Leadership Has Shifted East

In a fragmented world, economic leadership has shifted from the West to the East. The US grapples with overvaluation (Buffett Indicator at 219%, S&P 500 forward P/E at 27.5x), sticky inflation, rising unemployment, and diminishing AI returns relative to investment.

India, by contrast, offers healthier valuations (Buffett Indicator at 125%, Nifty-to-gold ratio below historical mean), stronger growth fundamentals, policy stability, and capital inflows. The Nifty’s one-year return of -4.6% reflects correction and opportunity, not structural weakness.

China is stabilising but battling deflation. Japan is normalising policy amid political uncertainty. Europe struggles with near-zero growth and sticky inflation.

India’s growth edge is intact, but vigilance is non-negotiable. Credit must revive, jobs must broaden, and urban demand must awaken for the momentum to sustain.

Final Thoughts: Walking on Thin Ice

October 2025’s markets embody paradox: strength shadowed by strain, confidence tempered by caution, leadership shifting beneath the surface.

India is still the standout. The fastest-growing major economy with robust fundamentals and policy clarity. But the ice beneath is thin: credit is tiring, jobs aren’t keeping pace with growth, tariffs create external drag, and demand is uneven.

The US flashes warning signals: policy contradictions, overvaluation, and an employment picture that’s forcing the Fed’s hand despite unfinished inflation battles.

Markets respect structure. Demand zones, supply zones, and technical levels matter because they reflect collective investor psychology and positioning. But fundamentals, growth, credit, jobs, and policy ultimately determine whether those zones hold or break.

Volatility is not noise in October. It is the market’s way of testing conviction, shaking out weak hands, and repricing risk. Those who stay disciplined, anchored in analysis rather than headlines, typically emerge stronger.

The strategy: tilt toward growth where it is real, trim froth where it’s excessive, hold steady on quality, and deploy cash where opportunity meets valuation. India leads, but with eyes wide open. Conviction, not blind optimism. Discipline, not drift.

Because in markets, as in life, the difference between skating gracefully and falling through isn’t the surface you’re on. It’s knowing exactly where the ice is thin.